If you are shopping for obtaining a beneficial HELOC with PenFed, you will need to request an excellent callback over the phone or on the web. This particular aspect are a primary drawback to own consumers just who favor on line qualities and you will software.

If you are PenFed is a good idea getting borrowers inside You.S. regions who don’t have numerous most other alternatives in terms of household collateral loan providers, new lender’s decreased an online application and you can shortage of rate visibility generated it a reduced score in our product reviews. If you would like correspondence thru cell, yet not, PenFed could be advisable for you.

Dealing with a neighbor hood bank implies that they have been expected to be familiar with your neighborhood. Consequently, they’ll be during the a better status to give streamlined attributes in order to ensure you get your mortgage canned and you can financed quicker.

Credit Commitment from Tx

Membership into Borrowing Union out-of Tx is actually accessible to those people just who meet the requirements according to particular criteria, for example remaining in a qualifying county inside the condition. While the maybe not-for-money organizations, borrowing from the bank unions normally try to solution one discounts onto your as the a member in the way of all the way down costs and costs. Nonetheless they promote a few of the exact same features that you may rating out of a primary financial including checking and offers membership, handmade cards, mortgage loans, and you will domestic equity items.

The credit Relationship regarding Colorado also offers both household collateral lines away from credit (HELOCs) in addition to family equity funds. Software might be filed on the web, but when you choose, you may want to phone call otherwise visit a department to get more suggestions. The financing Partnership of Texas’ HELOC tool provides the independency out of having a predetermined speed to the lifetime of the credit range. Subscription towards providers also entitles one to almost every other gurus, like deals on the wellness expenses, automated money, taxation planning software, and a lot more.

Western National Lender of Colorado

Based inside the 1875, the new American National Lender of Texas (ANBTX) has the benefit of of many services, plus put membership such checking and you may savings, IRAs, Cds, handmade cards, and you will loans. Within the mortgage items, ANBTX offers old-fashioned home loan services various family guarantee situations, also one another home equity funds and you can HELOCs.

Programs to have both family guarantee circumstances is registered on the internet. If you are not sure and that device is best for you, you can call and you may talk to an agent simply to walk you from the procedure. So you’re able to pick the best tool, ANBTX also offers an online investigations between the a couple of house security situations to stress a few of the differences such as for instance installment terminology readily available and you will minimum mark quantity.

How to locate an informed HELOC otherwise Domestic Collateral Financing Rate from inside the Tx

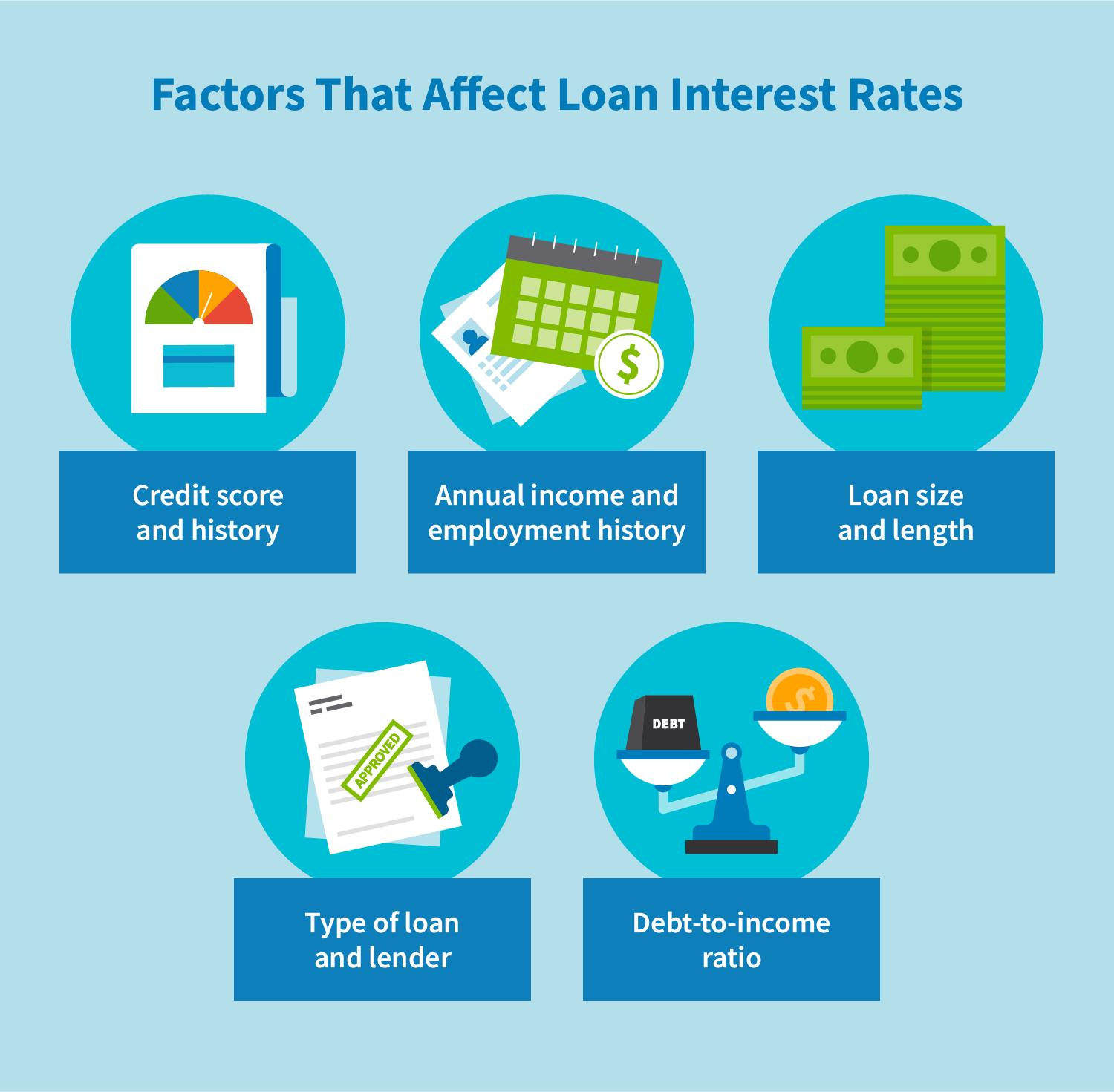

For the best price with the a good HELOC otherwise home equity loan regarding the state away from Colorado, it is very important score rates away from multiple lenders of various versions, credit unions, banks, electronic, regional and you will national. Sporadically, a loan provider can offer incentives instance a short-term marketing and advertising rates. Making it easier to contrast loan providers, you really need to promote each of them with similar pointers, for instance the amount borrowed, mortgage method of, together with assets that’s put due to the fact guarantee into the house guarantee financing.

When shopping pricing one of various other loan providers, make a note of exactly how much information the lending company brings online. https://cashadvanceamerica.net/loans/personal-loans-for-good-credit/ One particular clear and you may member-amicable lenders will offer the prices and you can costs on line in place of requiring any sort of tough credit score assessment who would negatively perception your own credit history. Also be conscious that the lender providing the lower speed can get not be the cheapest alternative when they recharging an excessive level of charge. A loan calculator helps you dictate the price of the borrowed funds.