Ahead of we discuss the apps, you can expect, therefore we promote Most of the Were created Loan imaginable that meet’s these conditions, why don’t we review initial a method to result in the techniques once the easy that one can.

First, There are no Promises Because there are Of several Unknowns.

Any banker otherwise financing officer that provides a hope try probably anybody we wish to stop. It is not protected up until you’ve fulfilled most of the conditions and you will signed your mortgage. However, let us discuss then how to have the wanted performance.

The audience is a leading Party Which have Wicked Punctual Rates & 5-Star Provider. Let me reveal Why!

Using and getting prequalified to have a good USDA loan is simply the first faltering step in the act; it does not be sure you’re going to get the pace, terms, or program you had been prequalified to have 1st.

Of a lot affairs head to reaching one to low rate and you will great system you desired, that https://availableloan.net/installment-loans-fl/memphis/ is the rate of which You disperse. Time performs up against the debtor when you look at the a massive ways having people mortgage.

Find out the cuatro Really-Very important Reasons to White The newest Flame Or take Timely Step In your USDA Home loan Pre-Qualification!

Price Locks Expire: Of many finance is closed to have a month because less identity makes you have the lower speed you are able to. For those who eliminate their rates lock by letting it expire or being required to extend it since you took weeks to get the factors back, it’ll cost you you more cash otherwise a higher level. Having cost has just rising, a high speed will make you don’t eligible for the brand new financing you wanted. A long reduce you can expect to need you to re also-qualify for the mortgage once again.

Applications You certainly will Drop-off: Its happened in advance of; there is observed of a lot financing programs get wiped out at once. Investors can decide adjust their risk profile preventing offering software altogether; that’s why moving timely for the recognition you’ve got within the your hands function taking action.

Your job otherwise Income Standing You’ll Changes: Imagine if you forgotten your work, your income is actually quicker, or if you planned to grab an alternate business, nonetheless it put your mortgage closing in danger because you took too-long? People alterations in your own a position condition you’ll get back with more undesirable terms otherwise, tough, a whole mortgage assertion.

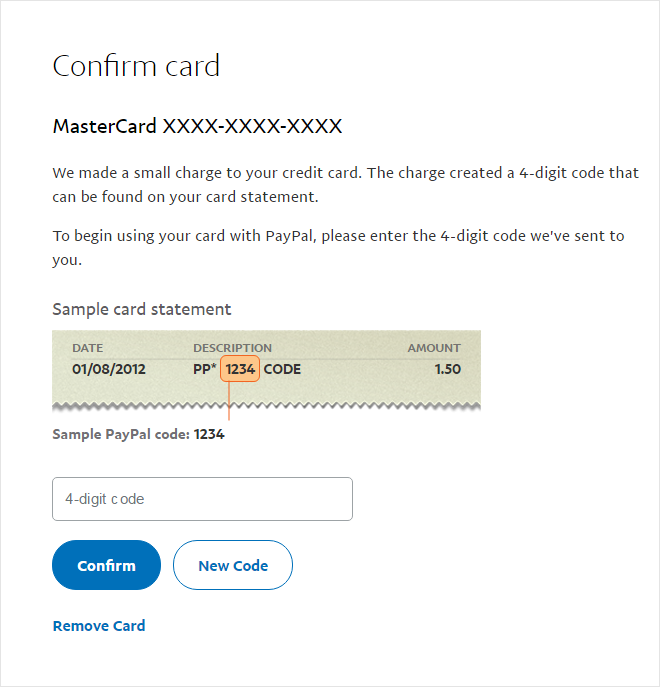

Your credit rating You can expect to Significantly Changes: We’ve viewed which takes place a couple of times. A borrower maxes out its mastercard getting business, otherwise they skip a cost as they just weren’t attending to, or judgment/range is actually registered for the majority of causes. Maybe not closure easily according to the exact same borrowing from the bank words is another reason underwriters need you to re-qualify otherwise cancel the borrowed funds.

Realize Such 3 Actions to obtain Competitively Valued USDA Mortgage rates now.

Select a loan provider you become positive about and apply to locate pre-accredited out of one to bank. Make sure the lender has the system you would like; they won’t sound sure capable romantic this program and also have the reviews so you’re able to back it up, upcoming continue looking! You can also here are a few all of our studies to help provide your which confidence.

Consult a speed lock on your own loan once you are pre-qualified and get your own bank every item required as fast as needed seriously to intimate your loan, which means your rates secure will not expire. Your own area of the processes is over in the event the mortgage is closed, perhaps not once you imagine your delivered sufficient documents to fulfill just what the lender is requesting.

Need obligation and circulate punctual; you may already know, cost have been increasing recently. Hold off too much time, while might end with a higher rate of interest, qualifying getting a smaller sized loan than for many who closed into the quicker on a lesser speed. It’s your jobs to be certain you see most of the standards, maybe not the borrowed funds officer’s or lender’s standing to hold this new file open as long as you can, buying the speed lock extension out of their pouch. Hair prices currency since your bank reserves the amount of money and you can price you would like. It’s your obligations to be sure you flow prompt in order maybe not so that one to secure expire, or it could end costing your.