FHA fund

Covered because of the Government Casing Management, FHA loans is actually well-known certainly earliest-time home buyers and their far more lenient borrowing and you can income criteria.

- The minimum deposit to possess an enthusiastic FHA financing are step three.5% having consumers with a credit rating of 580 or higher.

- If the borrower’s credit history falls anywhere between five hundred and you can 579, minimal downpayment requisite try 10%.

That it added cost are going to be tall, leading of several borrowers to look at refinancing in order to a traditional financing after he’s sufficient equity to stop MIP.

Va fund

Supported by this new Service out of Pros Items, Va financing are available to eligible pros, active-obligation services professionals, and particular enduring partners. Such loan doesn’t need a down payment, making it an attractive selection for earliest-date homeowners just who qualify.

Simultaneously, as opposed to almost every other mortgage systems, Va money do not require ongoing mortgage insurance rates. Yet not, they do wanted a single-date financial support percentage, that’s normally between step 1.4% to 3.6% of loan amount.

USDA funds

The new U.S. Company out of Farming (USDA) even offers loans to have eligible buyers into the outlying and you will suburban areas. USDA financing not one of them a down-payment, provided the brand new debtor matches earnings and you may qualifications requirements. These types of money are ideal for buyers looking a home within the eligible outlying parts and you may whom prefer to not ever provide a huge initial percentage.

Of several says, counties, and you can towns and cities give earliest-big date home client software that provide down payment advice or reduced-interest fund. These types of apps will often have certain qualification criteria, including money limits or a necessity to go to homebuyer knowledge kinds.

Jumbo loans

Jumbo funds is actually mortgages you to surpass the compliant mortgage restrictions put of the Federal Homes Finance Agency. Loan providers apparently consult large down repayments, constantly at the very least 10%.

Second residential property

A secondary home is a house that you inhabit on top of that to the number 1 home from the certain times of the year. This could be a holiday household, a week-end getaway, or a property near really works.

Minimal downpayment for a second house is usually higher than for a primary residence, usually up to 10-20%. Loan providers view this type of properties while the higher risk while the individuals be more browsing standard for the a vacation domestic than simply the number 1 residence through the financial hardship.

Funding functions

Money features is real estate purchased into intention of making income, both because of rental earnings, coming selling, otherwise both. Rather than a secondary quarters, this type of features aren’t useful personal exhilaration however they are solely for promoting income.

Minimum down costs having financial support qualities are often highest compared to the top houses, generally speaking 20% or even more. Simply because the better chance on the rental properties.

Mortgage options for investment features and disagree, with interest rates and you may qualifying conditions tend to becoming more strict compared to those for number 1 otherwise additional land.

Advantages of a more impressive advance payment

It requires time to cut enough currency to have a substantial down commission, thus a no- or reasonable-down-percentage mortgage could possibly get hasten your ability to order property. But you’ll find advantages to and also make a huge down-payment.

Lower interest levels

Individuals exactly who put down more income generally speaking discovered better rates of lenders. This is due to that a much bigger deposit reduces the new lender’s exposure because borrower possess much more collateral during the your house right away.

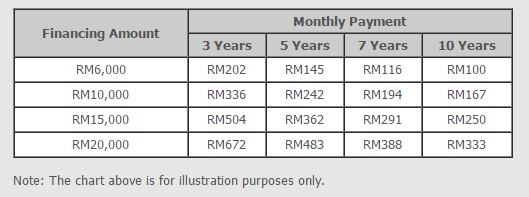

All the way down month-to-month mortgage repayments

You will end up resource less of the brand new residence’s purchase price if you set out a more impressive down payment. Consequently, your own mortgage repayments could be down per month, which will https://paydayloancolorado.net/cheyenne-wells/ make handling your monthly expenses much easier.