Re: Purchasing property but not getting into it? Is that Okay?

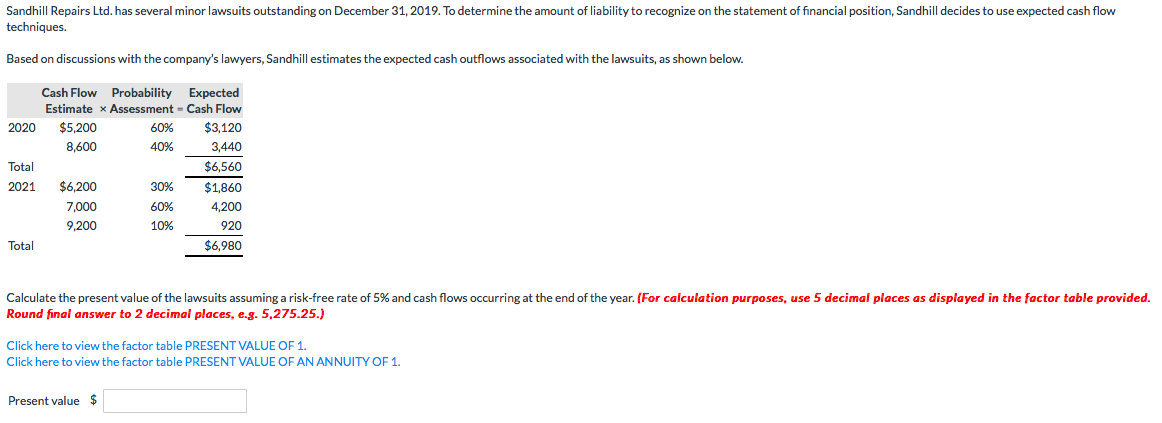

Verification away from Manager-Occupancy For all loans shielded by the a principal house which might be picked through the haphazard choices process (as well as finance picked through the discretionary alternatives techniques, given that relevant) new article-closing QC opinion need certainly to were verification from manager-occupancy. The financial institution have to comment the house or property insurance policy or other files regarding file (for example, assessment, taxation output otherwise transcripts) to confirm that there are zero evidence that the home is not brand new borrower’s dominant household.

Dividing it because of the six months returns a monthly test measurements of 40 fund

That does not mean most of the loan is totally audited having proprietor occupancy, but a particular fee is, and those which have warning flag are definitely more examined. Be careful on the market!

All the institution loans involve some quantity of QC opinion and you can review

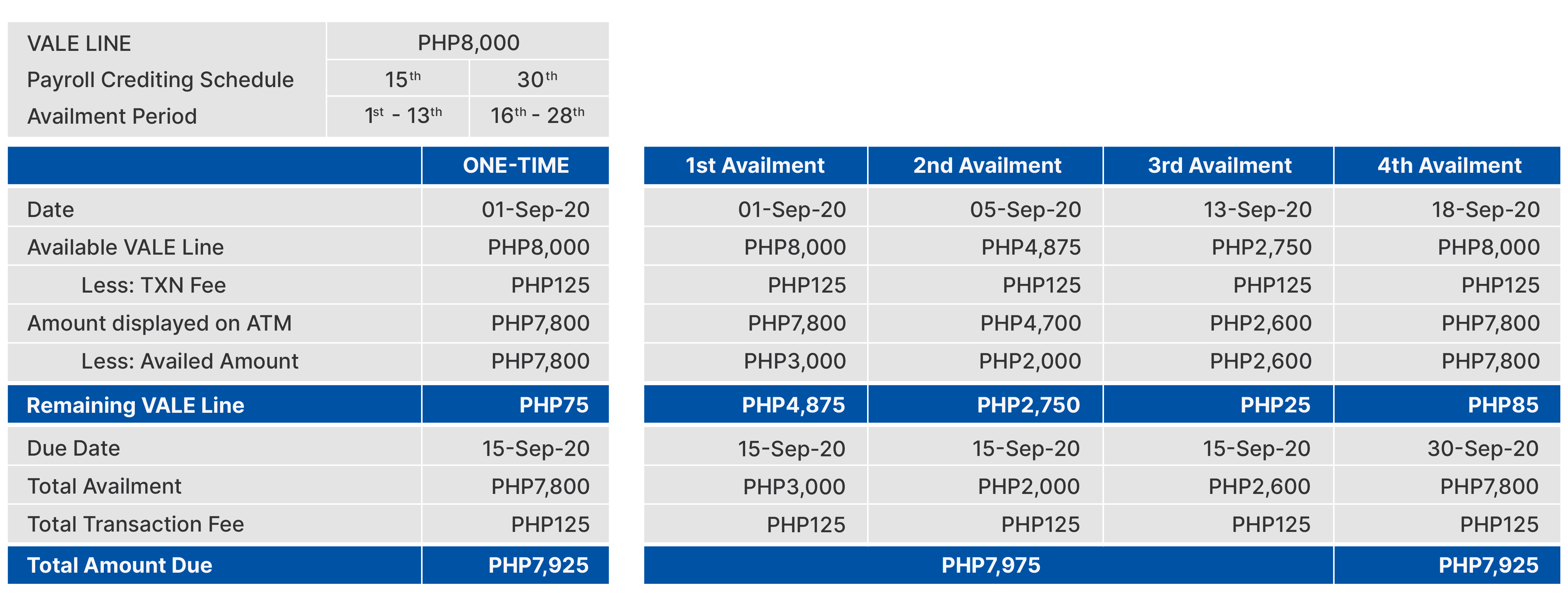

I did so it, actually refinanced after. The big situation is the intent, for those who enter the mortgage understanding you’re not attending live indeed there, but simply leaves it empty, then you need declare it as a holiday quarters. This doesn’t mean you might rent it regardless of if a number of (most?) financial contracts, normally you simply cannot perform it just after no less than per year unless of course your declare in advance the intent in order to lease and take an excellent high interest. Read More