USDA lenders render plenty of masters, that make them a famous alternative certainly one of a number of the household people i manage.

They provide the choice to possess 100% funding, versatile certification criteria, and you can competitive rates, certainly one of almost every other gurus. This means that, he’s a finance solution that provides certain whom will most likely not meet the qualification criteria to many other mortgage products the ability to get a house.

Interested in the newest USDA financial process? The following is a brief overview to help you know very well what to expect if you think this really is the best financial option for you.

The brand new USDA Home loan Procedure

Generally, the fresh USDA home loan process pursue an identical first techniques due to the fact other types of lenders. (You’ll find a general article on the borrowed funds process here , for source.)

Earliest, you will need to get a hold of a loan provider or agent you want to work well with. Just after that is over, run them to rating prequalified. This will include a glance at exactly how much you’re planning so you’re able to obtain buying property, your revenue and you can assets, your own monthly debts, plus borrowing from the bank.

As soon as your financial situation could have been assessed, your lender will provide an estimate out-of simply how much you can manage to purchase and certainly will let you know about whether or not you’ll be able to close off on a good USDA mortgage built into the advice your provided.

In case the prequalification appears encouraging, you could potentially proceed to the brand new action to be preapproved getting a USDA loan. It is a similar procedure, but alternatively of using rates for the economic suggestions, you can render particular data to suit your bank working out-of situated into the income tax documents, pay stubs, lender comments, and other economic data.

Taking preapproved does not mean youre secured an effective USDA loan, although it does indicate that you are firmly certified. As it can indicate so you can sellers and you will realtors that you’re a life threatening potential buyer, it could leave you a bonus with respect to while making now offers on belongings you find attractive.

2. Look for a property that fits USDA degree requirements

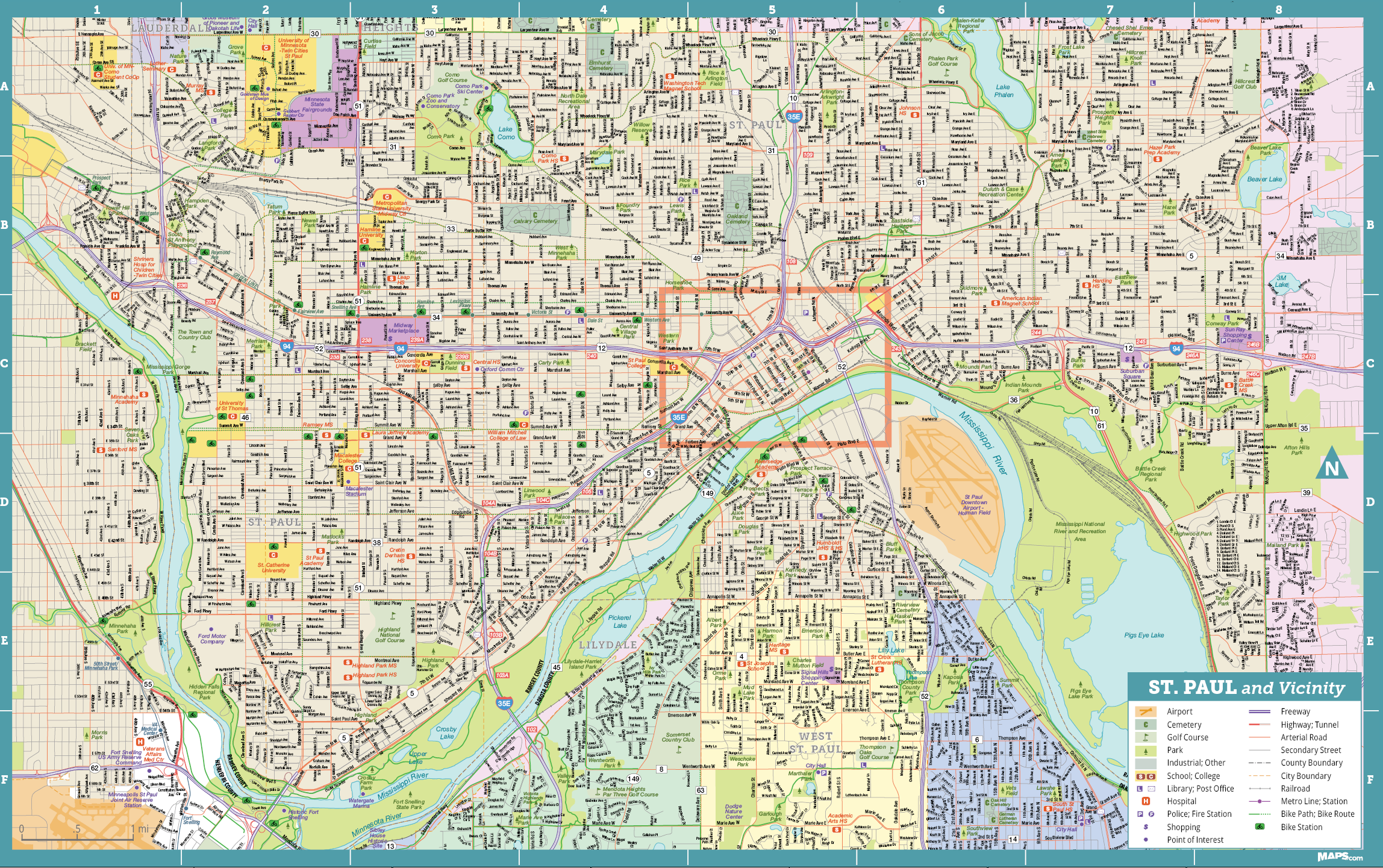

An individual will be preapproved having a USDA home loan, you will need to find a house that meets USDA financial requirements.

USDA financing are around for people buying features inside the rural portion. These outlying areas aren’t really rural, though-therefore perform some exploring into the urban area before if in case you simply will not qualify for a great USDA loan.

This is the one there’ll be no matter what particular mortgage you intend to utilize to invest in your home pick. You are able to work at the fresh new customers, more than likely using your real estate professional and you may lender, so you’re able to enhance a buy contract also information regarding the purchase price you’ll be able to purchase the house or property, who happen to be level closing costs , an such like.

There may be particular forward and backward to select terms and conditions. Once they are compensated additionally the purchase arrangement is actually closed, a beneficial USDA mortgage appraisal was bought with the intention that new compatible criteria are satisfied before you could move ahead.

cuatro. Loose time waiting for mortgage handling, underwriting, and you can approval

Adopting the agreement has been reached plus the domestic has been appraised , you are officially lower than price. Today, it’s time to hold off.

Their financial and an underwriter will work to each other to examine the document again to be sure, once and for all, you fulfill all of the certification criteria and that things are within the correct purchase to maneuver submit that have finalizing new income and you will closing.

5. Close on your own new home!

Once your loan file might have been cautiously examined and the bank while the USDA possess approved it, you’ll get phrase your obvious to close. It indicates you might agenda your own specialized closing and finally feel the state proprietor of your new house!

How much time Do The USDA Financial Process Get?

As right time having swinging through the USDA loan techniques will vary dependent on your specific condition, quite often it will require between 31 in order to two months to do.

Even though the procedure discussed more than will not cover that numerous tips, it could be time-taking accomplish and you may americash loans Glen Allen a while erratic sometimes. So though you’ll likely worry to get into your brand-new family, it’s important to be equipped for waits and you can setbacks because you approach the last obvious to close off.

Navigating the fresh USDA Financial Process with Maple Forest Money

Within Maple Forest Investment, we realize that a home is one of the largest requests the majority of people will ever create within lifetime. We’re thankful becoming an integral part of the home to order techniques to possess too many throughout Nyc County.

We and additionally recognize that the house buy procedure would be challenging and challenging if you’re dealing with it the very first time (or for next otherwise third even).

For this reason we’re right here, to guide you from means of acquiring a mortgage every step of means.

Has actually issues? Wondering in the event the an excellent USDA mortgage is right for you? Call us during the 518-782-1202 otherwise contact us online and we’d love the opportunity to part your from the proper advice.

Interested in learning more and more USDA mortgage brokers? Listed below are some our very own Help guide to USDA Mortgage brokers to get more info and you will of use posts on capital your house pick through the USDA.