- Likelihood of foreclosures: The most significant drawback is that if you don’t build your house guarantee mortgage payments are a danger of property foreclosure toward property your made use of once the guarantee.

- Maybe high rates and you will charges: When you’re family guarantee finance can offer down rates than simply particular choices, that isn’t constantly genuine having money features. Lenders will get evaluate this type of because the riskier, so you might deal with high cost and you may charge than a home equity mortgage on your no. 1 household.

- More strict requirements: Loan providers much more wary of money spent, therefore you will likely deal with stricter eligibility standards whenever obtaining a home guarantee financing. Might want to see www.cashadvancecompass.com/installment-loans-nd/portland an effective credit score, enough earnings, and you may sufficient security throughout the property in order to validate the borrowed funds.

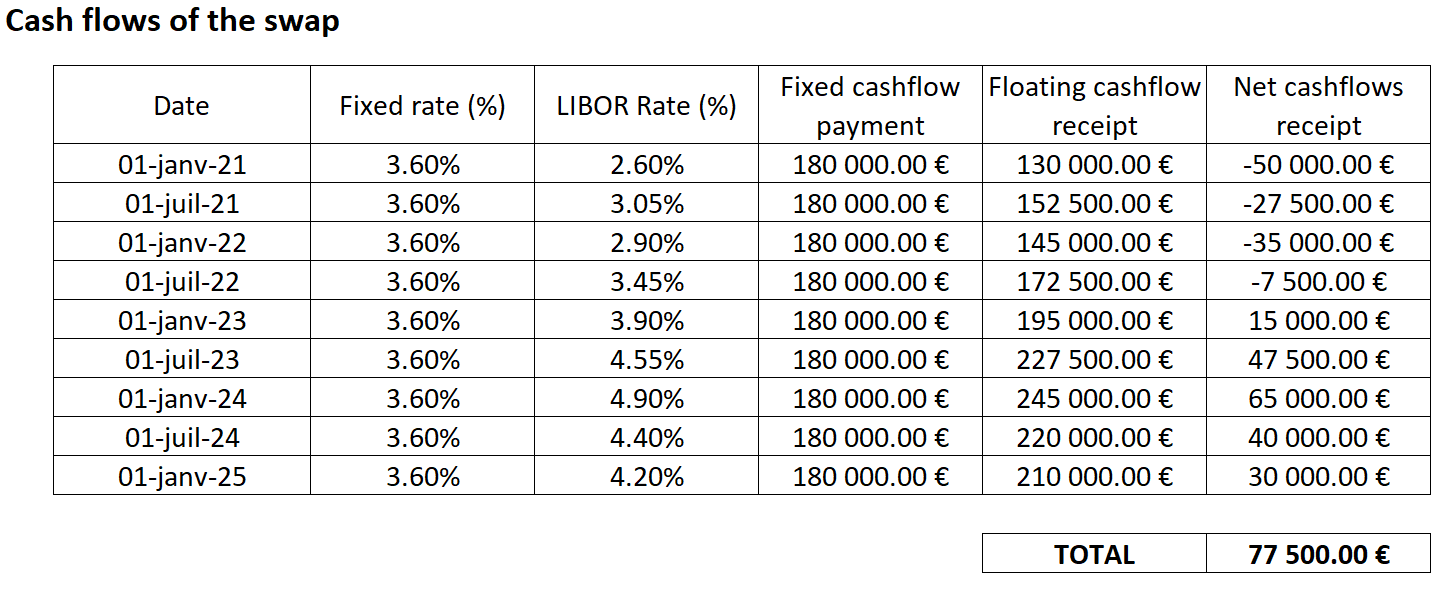

- Adjustable interest: Very assets credit line loans provides changeable rates of interest, definition their monthly obligations you will definitely raise in the event the rate of interest goes right up. This will generate budgeting and you will believe harder.

Whom offers HELOCs to the financing features?

Although loan providers promote HELOCs you are able to to suit your no. 1 house, the choices to possess lenders happy to expand an excellent HELOC to your resource possessions could be more restricted. Listed below are some you’ll be able to lenders you can strategy:

step one. Regional and you can national finance companies

Begin your hunt that have local and federal financial institutions. Local banks will render personalized provider and you will autonomy, when you find yourself federal banks promote a wide array of lending products and you will detailed companies. Examining both makes it possible to find the really advantageous conditions to own your circumstances.

dos. Borrowing from the bank unions

Local borrowing unions is also an option for a financial investment property HELOC. This type of affiliate-possessed establishments can be alot more versatile and provide best prices than old-fashioned banking companies. Remember that the financing connection might need one to feel good affiliate earliest from the opening a checking account with a little put before they approve the loan.

Some on the internet lenders focusing on home funding, plus HELOCS on the funding attributes, are seen recently. An internet lender would be a option for traders, while they will often have alot more lenient qualifications criteria for real house dealers.

Option types of financial support

If you are a line of credit are a good idea for your needs, it is not the actual only real variety of money spent financing available. Check out solutions to look at:

Cash-aside refinance

A money-aside refinance was replacing your current financial with a brand new, larger financing and you may using difference in dollars. This will leave you a lump sum payment regarding finance to possess expenditures or any other expenditures but can produce high month-to-month mortgage repayments and additional settlement costs.

Opposite financial

Getting people avove the age of 62 which individual its money functions outright, a contrary mortgage provide a supply of tax-free earnings by tapping into the brand new equity inside their characteristics. You need to be aware contrary mortgage loans will be challenging and have now significant costs and you can constraints.

Unsecured unsecured loan

If for example the money spent doesn’t have enough collateral, you could potentially imagine an unsecured loan. Although not, as the lenders dont safer so it financing type having assets, they often deal higher interest rates.

Cross-collateralization financing

Such loan makes you make use of the guarantee regarding multiple financial support features just like the security having a single mortgage. It can provide higher credit power but could plus present much more of the assets to possible risk.

Line of credit to your rental property

A credit line on your initial investment assets will be an excellent rewarding economic tool, that gives the flexibility and you will accessibility you want for your a home paying organization.

Explore the many personal lines of credit to decide their fit for your position. Knowing the pros and cons can help you decide if it financing alternative aligns along with your money goals and you will chance endurance.