3.Qualifications Conditions having Joining a cards Commitment [Unique Website]

– Occupational credit unions are open to employees of a specific company, industry, or profession. These credit unions are often created by workers who want to have more control over their financial services and benefit from the collective bargaining power of their group. Some examples of occupational credit unions are Navy government Borrowing commitment, which serves members of the military, veterans, and their families, and Teachers Federal Credit Union, which serves educators and school employees in New York.

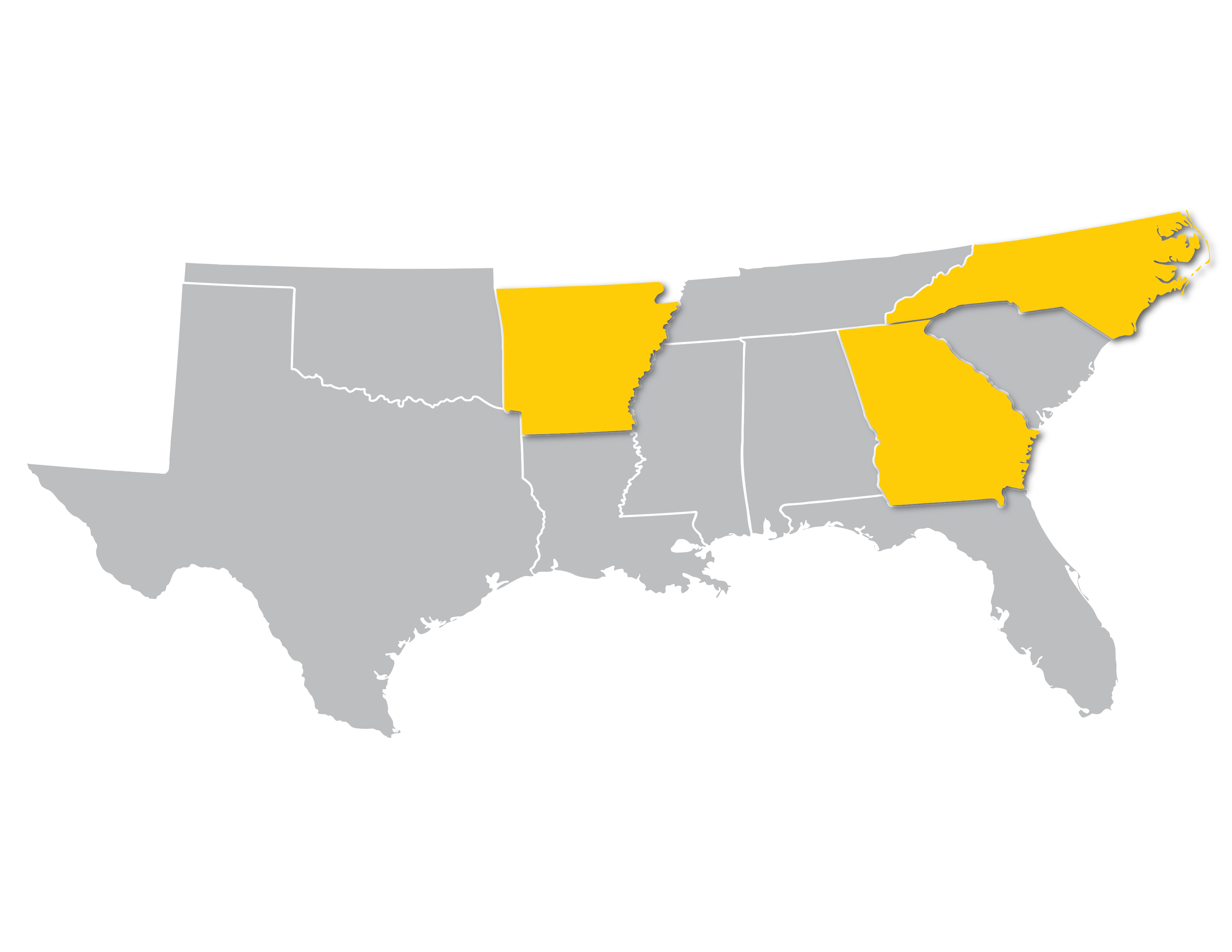

Location: Certain borrowing unions are based on a geographical town, eg a city, state, state, or part

– Associational borrowing unions are available to members of a particular organization, pub, or relationship. This type of credit unions are usually molded of the people that share an effective preferred focus, hobby, or produce. Some examples off associational borrowing from the bank unions is actually Western Airlines Federal Borrowing Relationship, and that serves people and you may employees of your Western Airlines Group and you may their subsidiaries, and you can Lutheran Government Credit Commitment, hence provides members of new Lutheran Chapel as well as associated communities. Read More